Collect-X

What is CollectX?#

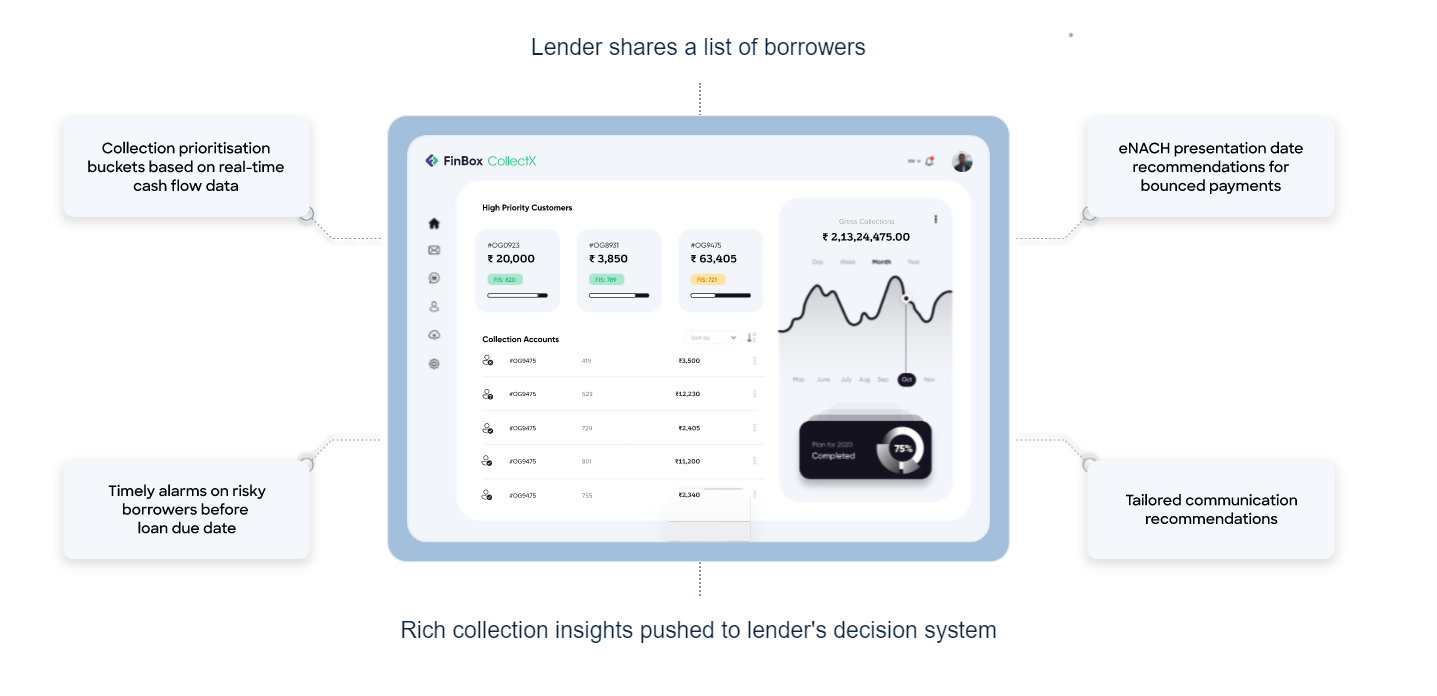

FinBox CollectX enables lenders to take empathetic remedial measures without alienating customers with predatory collection practices.

It is an intelligent, data-driven collection prioritisation and early warning sysytem - helps lenders continuously assess borrowers' ability to repay loans with real-time analysis of their digitally active credit portfolio. It enables them to take empathetic remedial measures without alienating customers with predatory collection parctices. It help lenders optimize resources for maximum collection.

What do you get?#

- Real-time insights - An artificial intelligence (AI) engine analyses spending behaviour, credit utilization, credit quality etc. to assess a borrower's financial health. It identifies potential defaulters, allowing lenders to trigger corrective actions preempting a default.

Risk prioritisation

CollectX compiles a report every two weeks before the EMI due dates to prioritize borrower accounts as per high, moderate and low risk

Optimize Collection Resources - CollectX prioritizes accounts based on default risks and help lenders intelligently allocate requisite colleection resources as per severity. Since the borrower segmentation is in real time, these resources can be orchestrated for maximum throughput.

Tailored Communication - With a better lead time, lenders can work together with borrowers to arrive at a mutually-beneficial resolution. Lenders can approach borrowers with tailored communication via preferred channels, improving net promoter scores and customer retention.

Seamless Integration - CollectX leverages an API for seamless integration with lenders' existing collections systems and is ready to go live within three days.

How it works?#

- Creating the watchlist - A lender creates a watchlist comprising credit borrowers.

- Analysing the watchlist - CollectX analyzes the watchlisted borrowers for potential red flags, such as account balance lower than the EMI, recent delinquencies, self-transfers when the due date approaches etc.

- Sharing the report - A report on priority order for collections is shared with the lender 7-10 days before the due date.

- Real-time warnings - CollectX triggers real-time warnings whenever borrowers' account balance gets replenished to enable lenders to drive up eNACH re-presentation success rates while minimizing bounce charges.

Key Features#

- Seamless Integration via APIs with your existing collection system.

- Real-time insights of borrowers' financial status.