Buy-Now, Pay-Later

Introduction to Buy-Now, Pay-Later#

FinBox allows you to offer buy-now, pay-later (BNPL) at checkout within your platform. It is a short-term financing option that addresses MSMEs’ liquidity crunch, allowing them to purchase now and pay for it in installments later.

FinBox activates a credit line for your customers to avail of BNPL and manages the lending journey end-to-end. Plugging BNPL into your platform can help improve a number of business metrics like AOV, GMV and CLTV.

About Buy-Now, Pay-Later#

- Buy-Now, Pay-Later is powered by a credit line (or an Overdraft Account).

- The Credit Line is approved instantly.

- The BNPL feature is activated in 1-2 working days

- All subsequent transactions are instant.

- User can make multiple BNPL purchases from the checkout screen

- The Credit Line is valid for 1 year.

- We support multiple repayment models, based on your target demographic.

- Each transaction is a bullet loan (i.e the repayment should be done all at once)

- The repayment tenure is flexible.

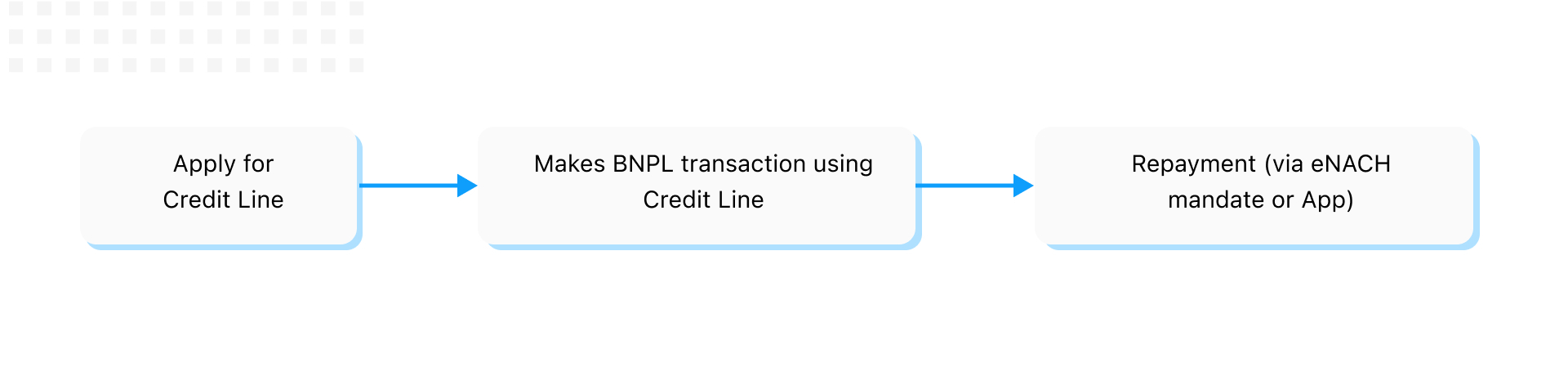

User journey#

BNPL User Journey

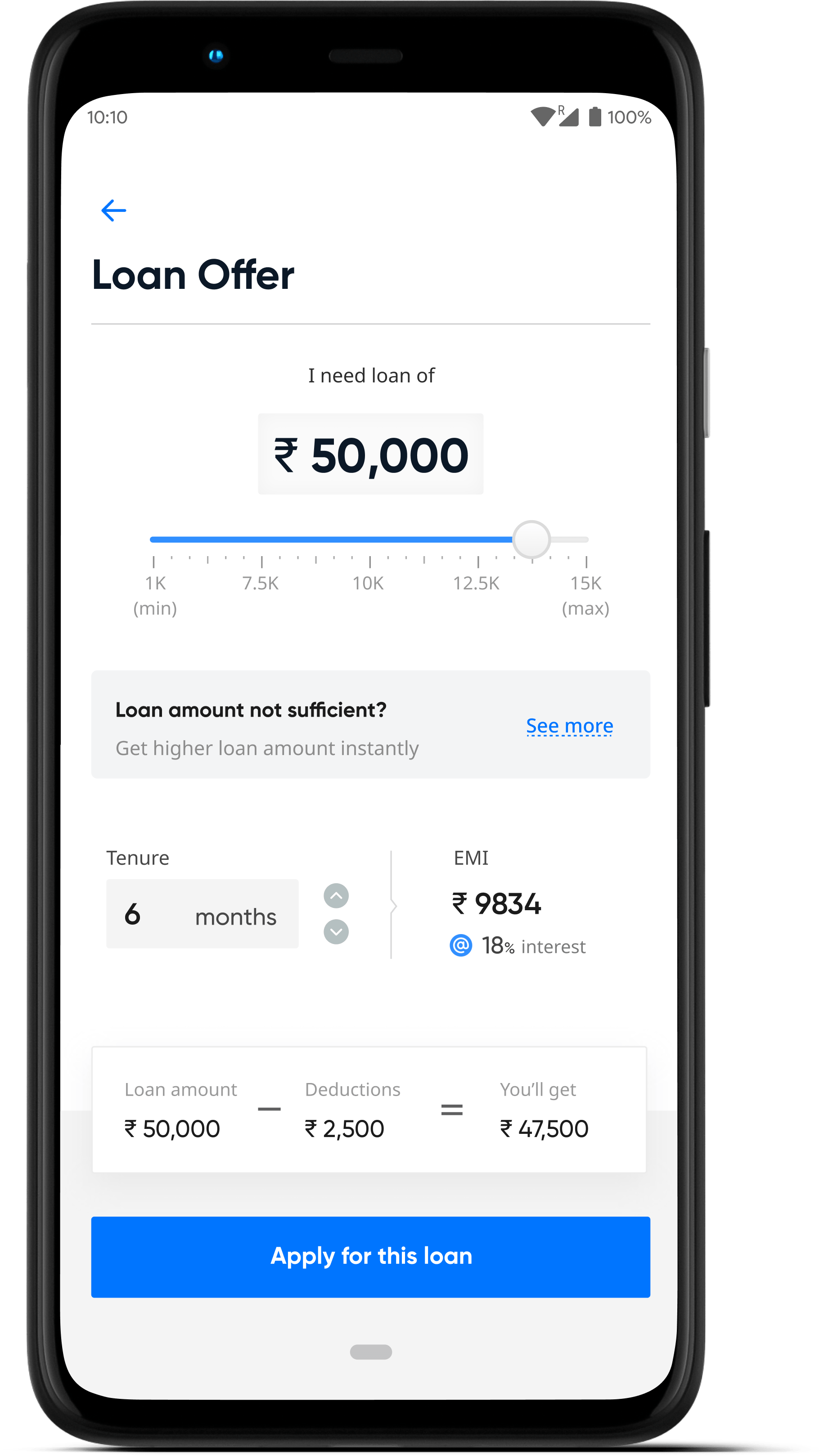

Part 1 - User applies for a credit line#

User is shown an offer to apply for a credit line - The first step in the user journey is applying for a credit limit which powers the Buy-Now, Pay-Later. The user will first see the option to activate his credit line via a banner in the anchor app.

User shares his data and his eligibility is checked - The user shares his Credit History, Device Data, Bank Statements, GST (if applicable)

E-KYC - Following this the user completes his eKYC by submitting his

- PAN Card

- Address proof (Aadhaar or Passport)

- Selfie

- Business registration proof.

Completes the application process - User e-signs a loan agreement and the application journey is completed.

Banner shown in anchor app

User is shown eligibility

Credit Line Activated

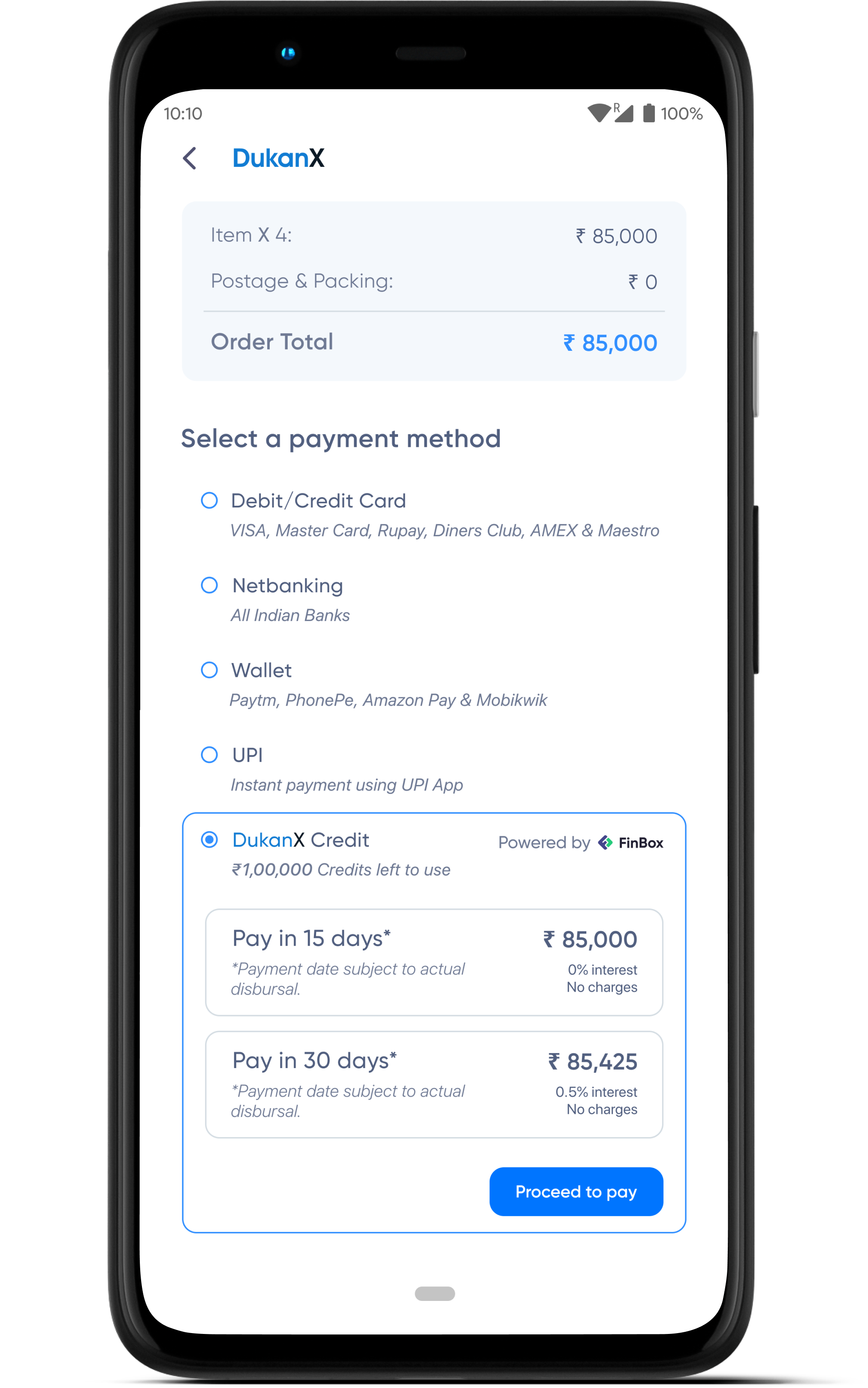

Part 2 - Making Transactions#

- See BNPL option at checkout - Users will see BNPL as a payment option in the Anchor app's checkout page.

- Select repayment plan -They can select their preferred repayment plan and make instant transactions on credit.

User is shown a BNPL option at the checkout screen

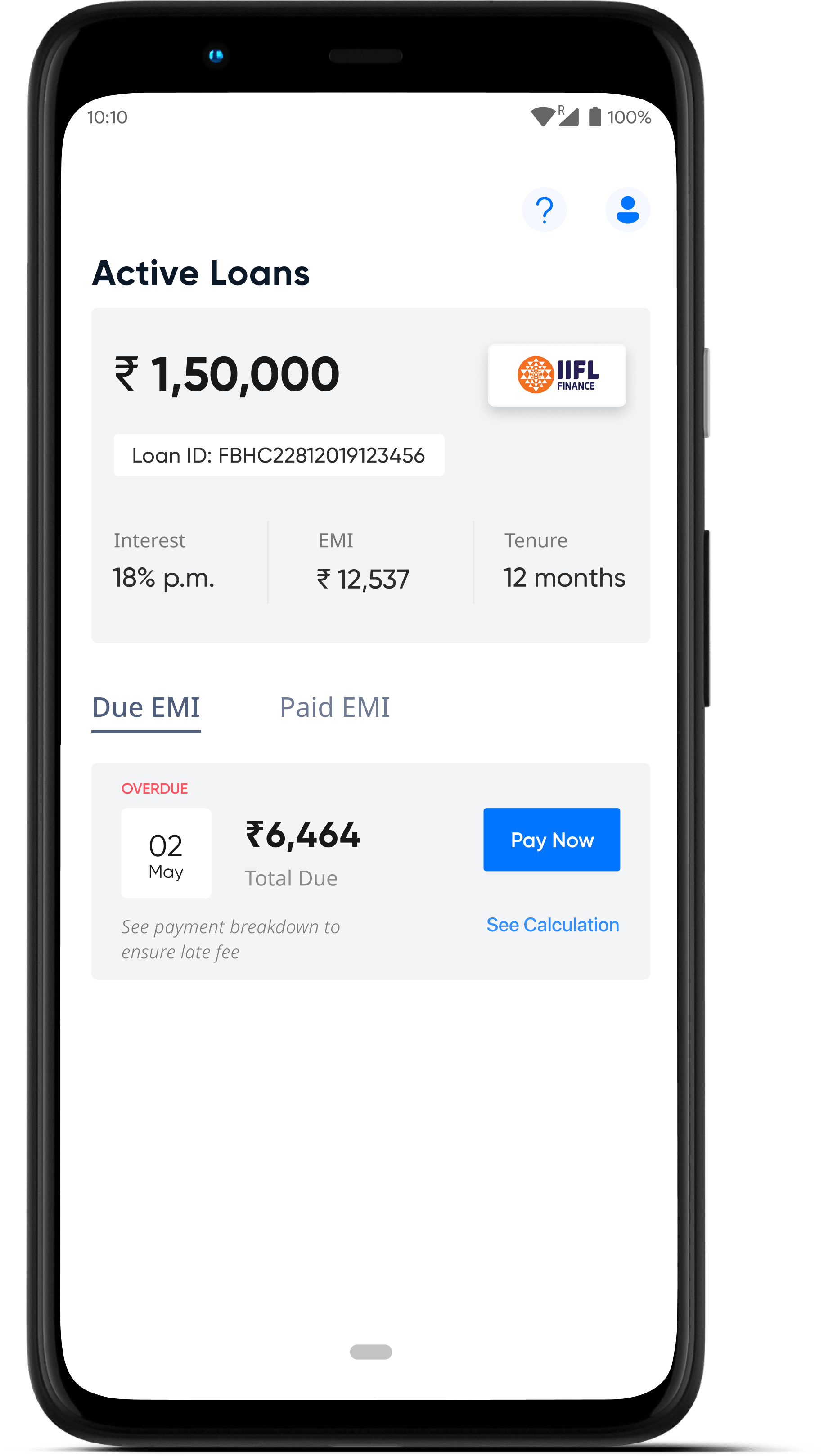

Part 3 - Repayment#

- EMI amount is auto-debited using eNACH or Mandate

- Users can repay from within the app if they want to pay before the due date.

Loan Status