Customer Onboarding

Onboarding involves acquiring new customers, accepting their documentation and verifying their identity. The process is crucial for decisioning, which is why lenders must perform it meticulously - by managing the sheer volume of applicants as well as providing a good customer experience.

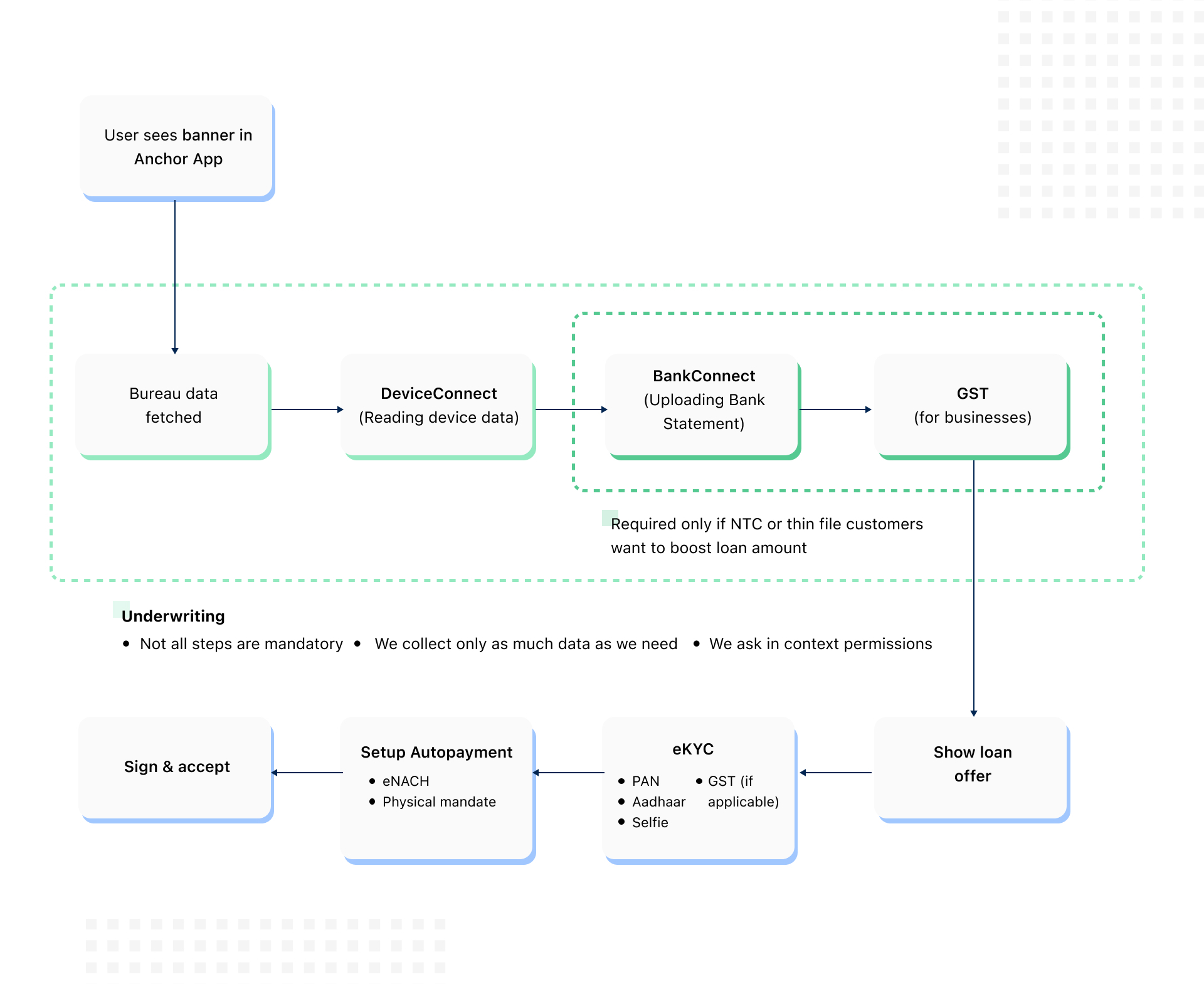

FinBox’s adaptive journeys offer tailored onboarding for different classes of customers. Intelligent onboarding takes each customer only through the necessary steps, thereby avoiding high drop offs.

Sample Customer Onboarding Flowchart

Here are the activities involved in onboarding a customer#

- Running marketing campaigns to attract new customers

- Showing banners in your platform to apply for a loan.

- Facilitating flow of data for underwriting

- Bureau Data

- Alternate Data such as device data, bank statements, GST Data, cash-flow data

- Bank details, PAN card, phone number and other personal details for identity verification

- Identity and Document checks - There are various checks in place to ensure consistant and authentic information is submitted by the user

- Confirmation calls from the lender, platform to personally inform the user of the terms of credit and repayment plans.

Adaptive Journeys#

However the journey is adaptive, so we only collect as much as we need. Borrowers are onboarded as per their creditworthiness. Premium borrowers will be onboarded in fewer steps. Thin-file customers will have the option to share their data through various ways to acquire the loan.

This ensures -

- 50% fewer drop-offs.

- 30% fewer NPAs

- Lower overall CAC

- Higher CLTVs

Assisted Journey#

Assisted Journey is a form of onboarding in which we have minimised the effort that has to be undertaken by the borrower.

- We collect information about the borrower that our anchor partners already have.

- We autofill all the loan application based on this data.

- The borrower only has to complete eKYC and accept and digitally sign the agreement.

This drastically reduces drop-offs and TAT of the onboarding process.