Nomenclature

Embedded Finance#

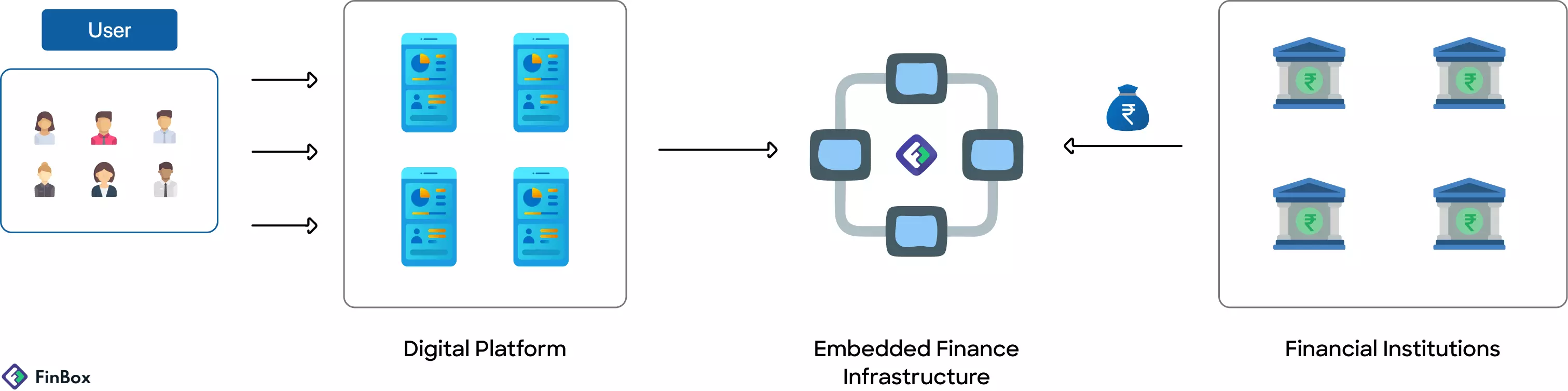

Embedded Finance - Embedded Finance is the seamless integration of financial services into a traditionally non-financial platform. It enables customers of existing digital platforms (Anchor platforms) to access financial services within the app and in-context.

Anchor Platform - Non-FinTech companies / businesses that own a customer-facing digital platform such as a mobile app, a website, or a desktop application. With their deep understanding of target audience segments, they can offer customized financial solutions to customers, 'embedded' within their platform.

Lenders or Financial Institutions - Banks / NBFCs / small finance banks. Their function is two-fold. They provide financial services, and are best positioned to manage regulatory, compliance, and credit risk. They use their network and manpower to manage and service loan requests from the Embedded Finance ecosystem.

Embedded Finance Infrastructure Company - A FinTech company that creates end-to-end software tools (APIs and SDKs), and connects financial institutions with the digital platform and embedds financial products within the Anchor Platform. It also provides crucial value-added services like loan lifecycle UI, alternate data underwriting engines, customer servicing, and more

Risk Assessment#

Credit Policy - A set of rules decided by a financial institution that measures the creditworthiness of a borrower and determines whether to approve the loan.

FLDG - First Loan Default Guatantee - FLDG is an arrangement in which a third party (such as FinBox) can compensate some of the losses of non performing loans and take some risk off from the financial institution financing the loan.

Subvention - When a digital platform subvents (or absorbs) some of the cost of lending so its customers (borrowers) may get it at a discounted fee.

Underwriting - Underwriting is a process of determining the credit worthiness of a customer. It includes user authentication and risk-assessment.

Traditional Underwriting - Traditional underwriting refers to how financial institutions have been assessing the creditworthiness of borrowers - with credit history data from credit bureaus.

Adaptive Journey - Borrowers are onboarded as per their creditworthiness. Premium borrowers will be onboarded in fewer steps. Thin-file customers will have the option to share their data through various ways to acquire the loan.

Repayment#

Flexible Repayment - Customers can pay the EMI before the due date. In overdraft the user may any amount above the minimum bill.

Flexible Tenure - Tenure is the duration of repayment of borrowed loan. You can offer multiple repayment tenures and allow the borrower pick the tenure that suits him.

Multiple payment methods - Various modes of repayment is supported -

- eNACH

- Phyical Mandate

- in-app Payment Gateway