Personal Loans

Introduction to Personal Loans#

Offer loans for personal expenses to customers within your platform with FinBox. Our robust underwriting engines ensure that you lend these unsecured loans only to the most trustworthy borrowers.

We take care of the entire loan process from end-to-end - onboarding, underwriting, verification and disbursement. You can instantly disburse the loan and offer flexible repayment plans as per customers’ convenience.

About Personal Loans#

- We support multiple repayment models.

- Tenure and repayment is decided by the lender

- The repayment tenure is flexible.

- Borrower can pay the EMI before the due date.

- The EMI amount is deducted directly from future salary.

- The loan is non-collateralised

User journey#

Part 1 - Applying for Loan#

- User is shown a banner to apply for a personal loan - The user applies for a personal loan.

- User shares his data and his eligibility is checked - The user shares his Credit History, Device Data, Bank Statements.

- Bank Details - Then user is asked for bank account details and we do penny drop to verify.

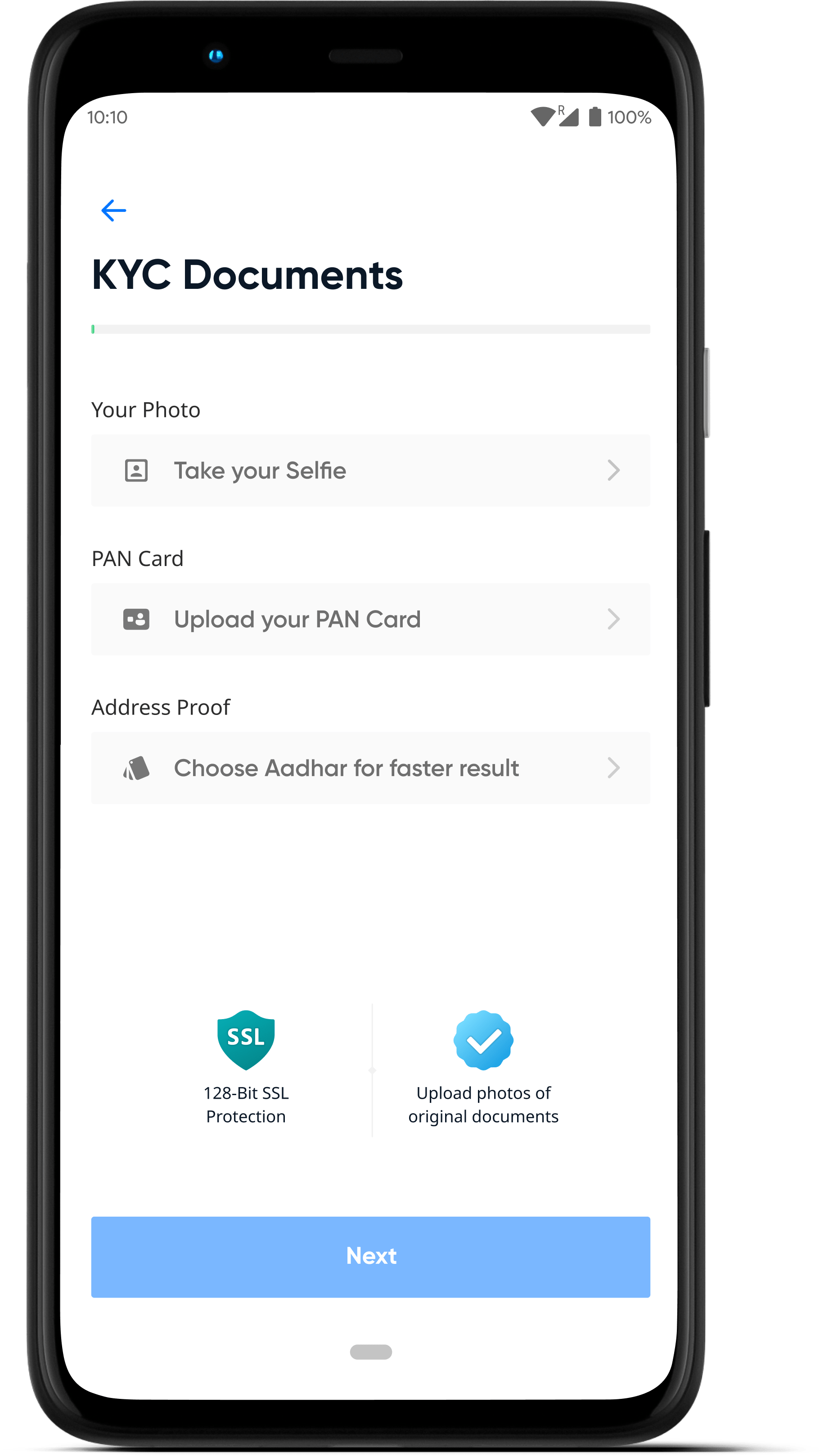

- User completes E-KYC - Following this the user completes his eKYC by submitting his

- PAN Card

- Address proof (Aadhaar or Passport)

- Selfie

- User sets up ENACH - User sets up autopay. There are 2 ways of doing so depending on the bank -

- E-NACH

- Manual NACH

- User signs the loan agreement - User signs a loan agreement and completes the application journey.

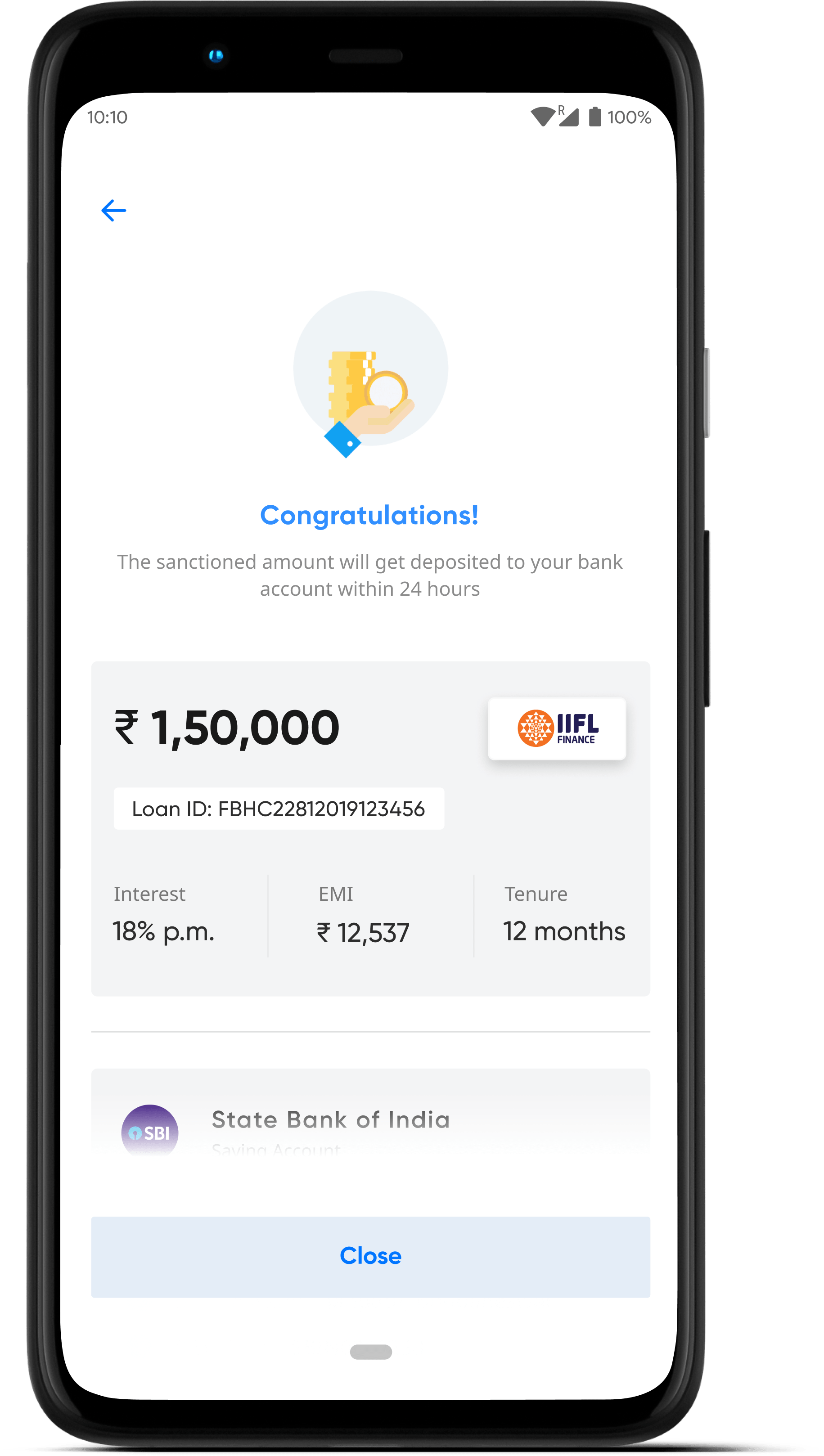

- Loan Disbursal is done - The loan amount is transferred to users’ bank account and they can use it at their own convenience.

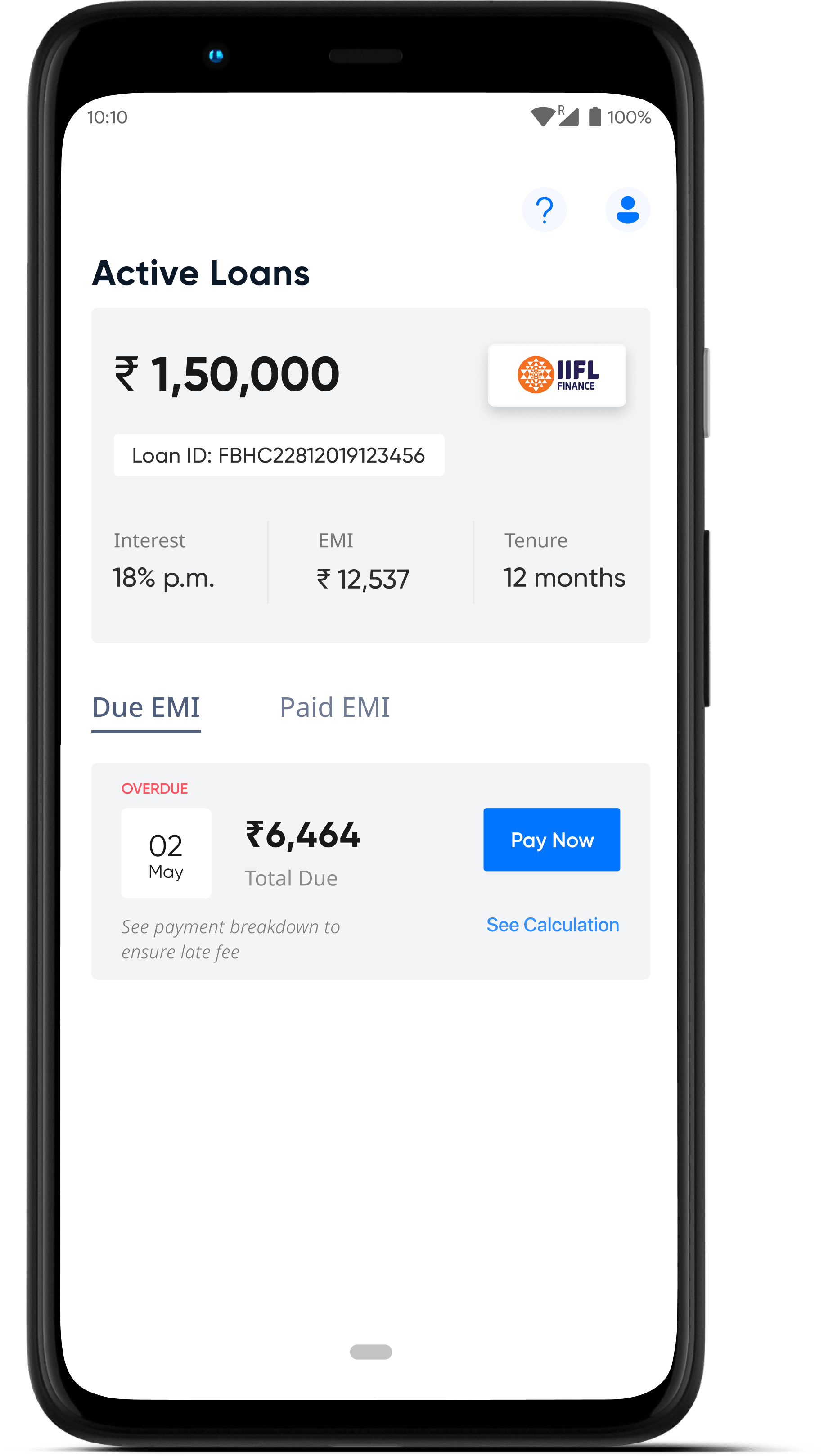

Part 2 - Repayment#

- Repayment is done by NACH

- User can also pay the EMI before the due date from app.

A platform offering Personal Loan

Fetching credit score of borrower from bureau

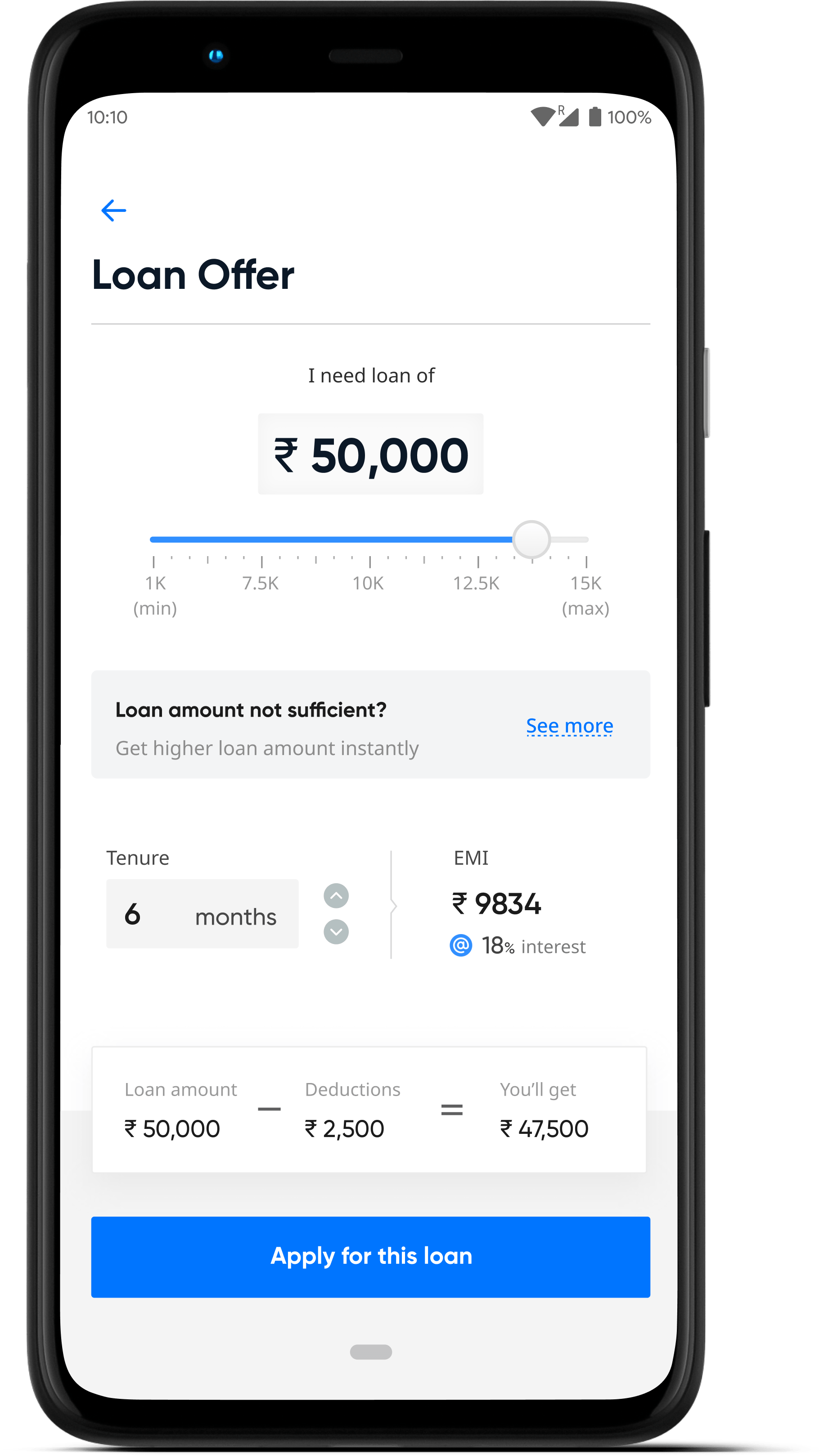

User is shown eligibility

User is asked to provide details for eKYC

Loan Disbursed

Loan Status