Term Loans

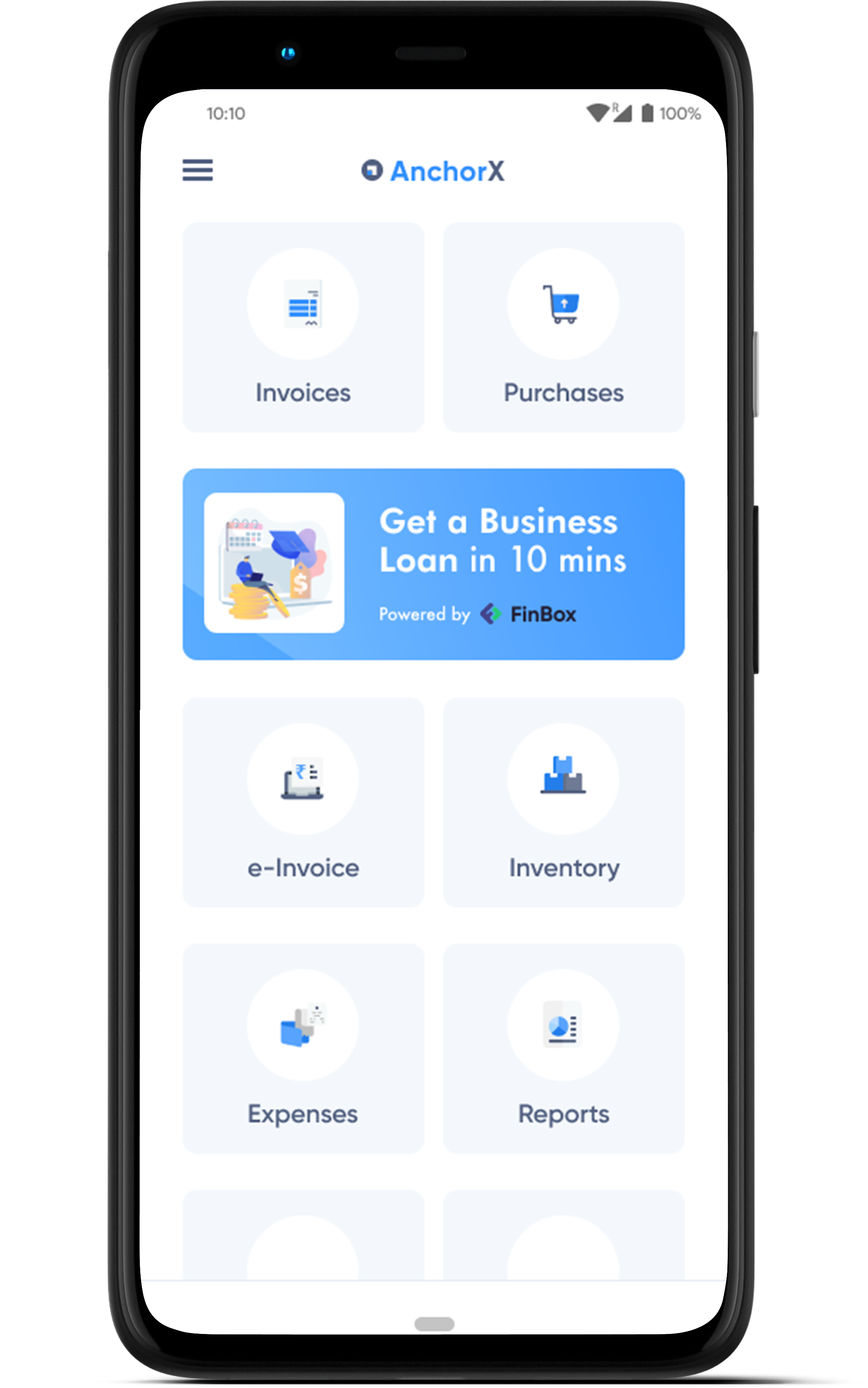

Embed FinBox term loans into your platform to empower your customers to meet all manners of business expenses - for working capital, purchasing assets, or for expansion. Offer the unmatched convenience of financing within the platform itself, and enhance your overall customer experience.

About the Term Loan#

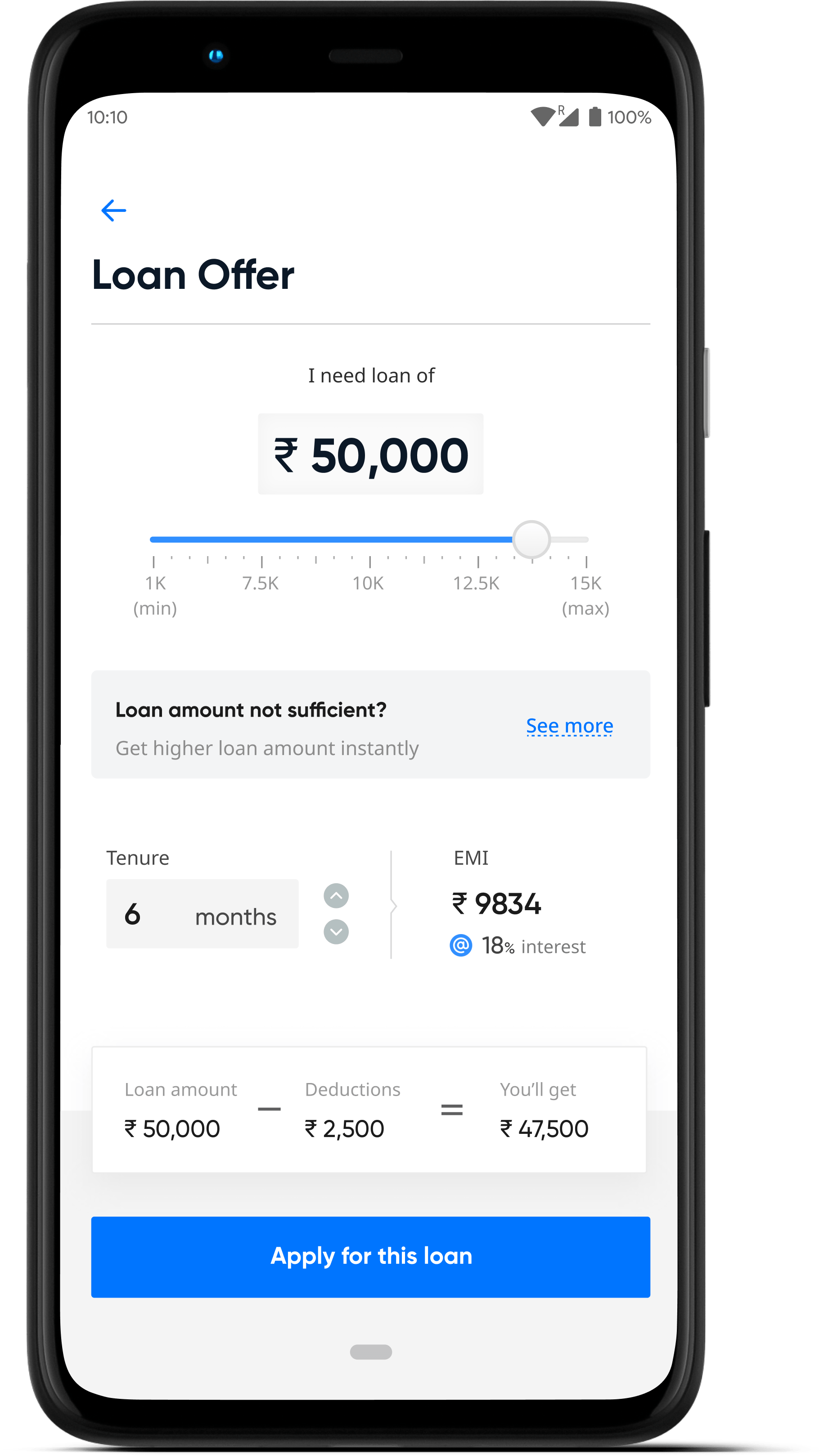

- The loan amount up to 5 lakhs

- Loan tenure can be from 6-60 months. It is decided by the lender.

- Instant approval

- Completely digital loan application

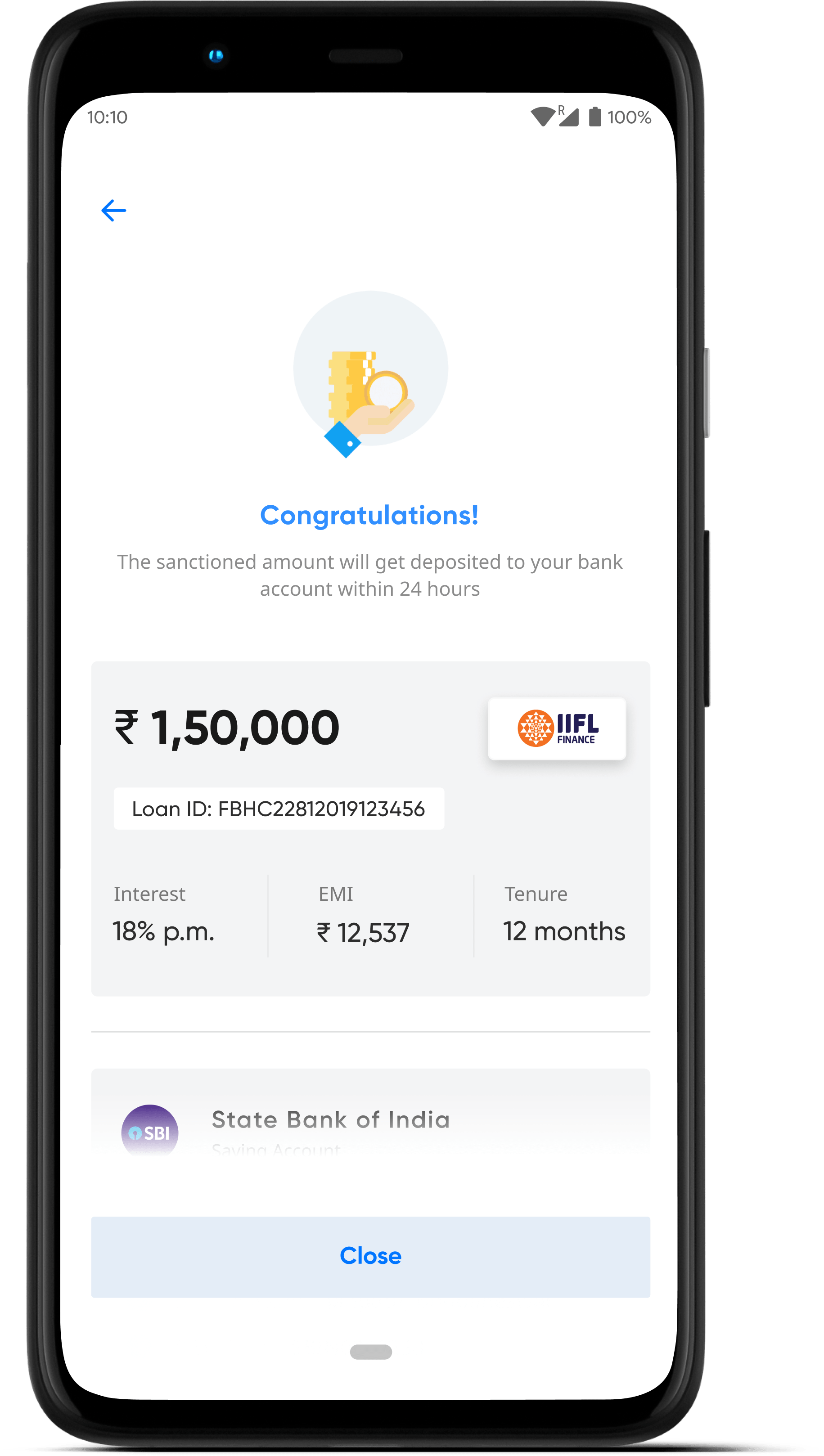

- Loan amount is disbursed in 24-48 hours

- Collateral-Free loans

- Transparent loan application process with no hidden fees

- Multiple Repayment Modes

- Prompt customer support

- Flexible repayment - Customers can pay the EMI before the due date.

User Journey#

Part 1 - User applies for a Term loan#

- User sees a loan offer banner - The user clicks the banner which initialises the SDK powered by FinBox.

- User gives the consent to share data - User gives the consent to share the credit history, device data (DeviceConnect), bank statements (BankConnect), GST (if applicable)

- Complete the e-KYC - User completes e-KYC by submitting PAN Card, Address proof - Aadhaar or Passport, Selfie and Business registration proof.

- User creates a mandate - We support e-NACH and physical mandate for the convenience of the user.

- User signs the loan agreement - User digitally signs the loan agreement and completes the application journey.

- Loan disbursal - Loan amount gets credited to the user account within 24-48 hours.

A platform offering Business Loan

User is shown eligibility

Loan Disbursed

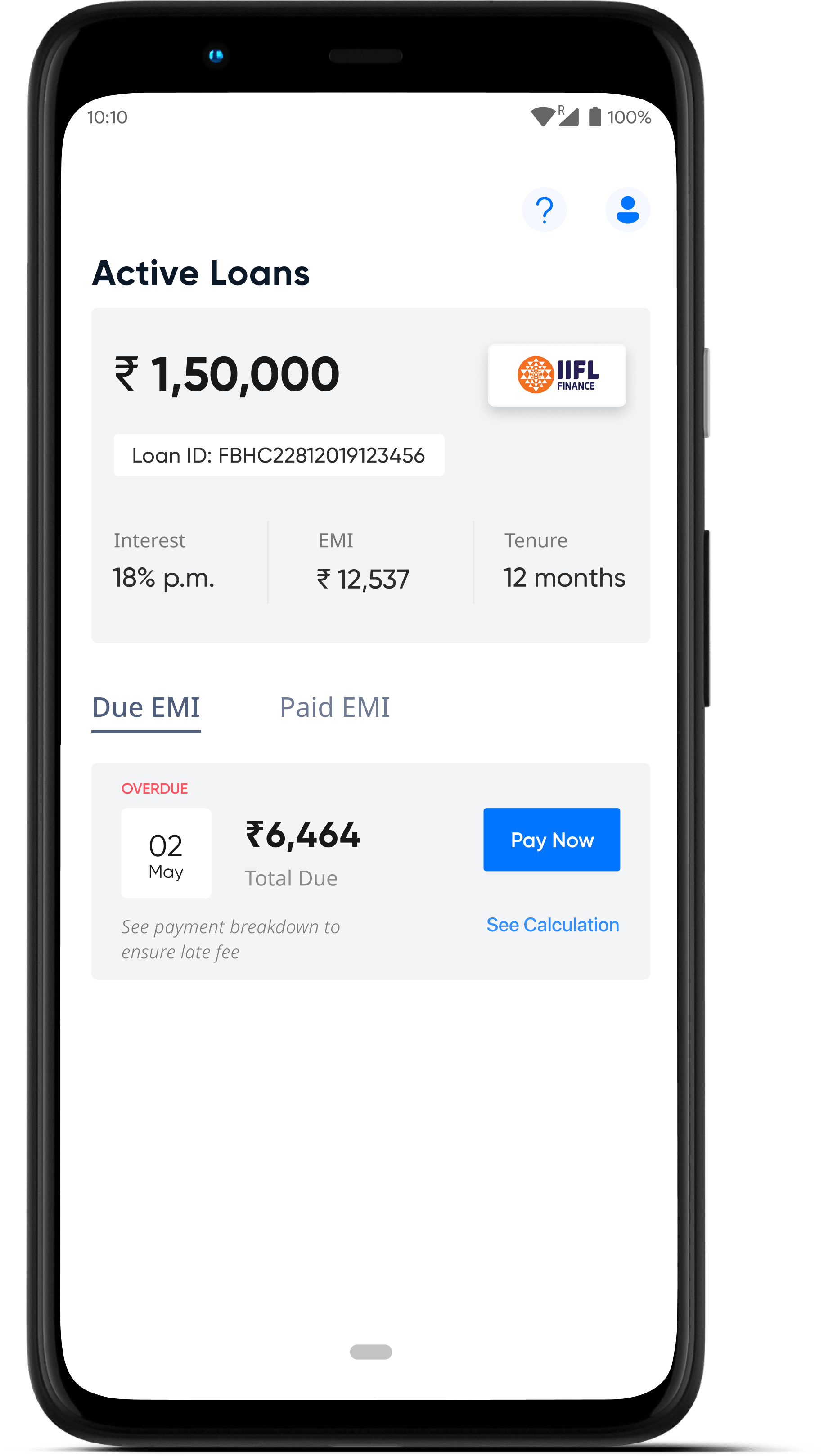

Part 2 - EMI Repayment#

- Payment Reminder - We remind the customer to pay the EMI through app notifications and SMS.

- Automatic deduction by NACH presentation - NACH is presented for the EMI deduction.

- Borrower can choose to repay before the due date via the app

Loan Status