Credit Line

Introduction to Credit Line#

A steady stream of funds is better than a number of loans for different purposes. With FinBox, offer a recurring and embeddable credit line - a loan product for which customers must apply only once.

They can withdraw money instantly as demand arises and repay in a flexible manner over a tenure and at an interest rate of their choice. We charge interest only on the amount actually withdrawn and replenish the credit line with the payment of each installment.

About Credit Line#

With the FinBox Credit Line, you can build -

Closed Loop Credit Line (The money is directly disbursed to you rather than end-customer. See B2B-E-Commerce BNPL)

Open Look (Loan is disbursed to the borrower)

The Credit Line is approved instantly.

Credit Line is activated in 1-2 working days

The credit line can be offered as a BNPL option or a revolving line of credit for working capital needs.

All subsequent transactions from the credit line are instant.

The Credit Line is valid for 1 year.

We support multiple repayment models, based on your target demographic.

Each transaction is a bullet loan (i.e the repayment should be done all at once)

The repayment tenure is flexible.

User journey#

Part 1 - User applies for a credit line#

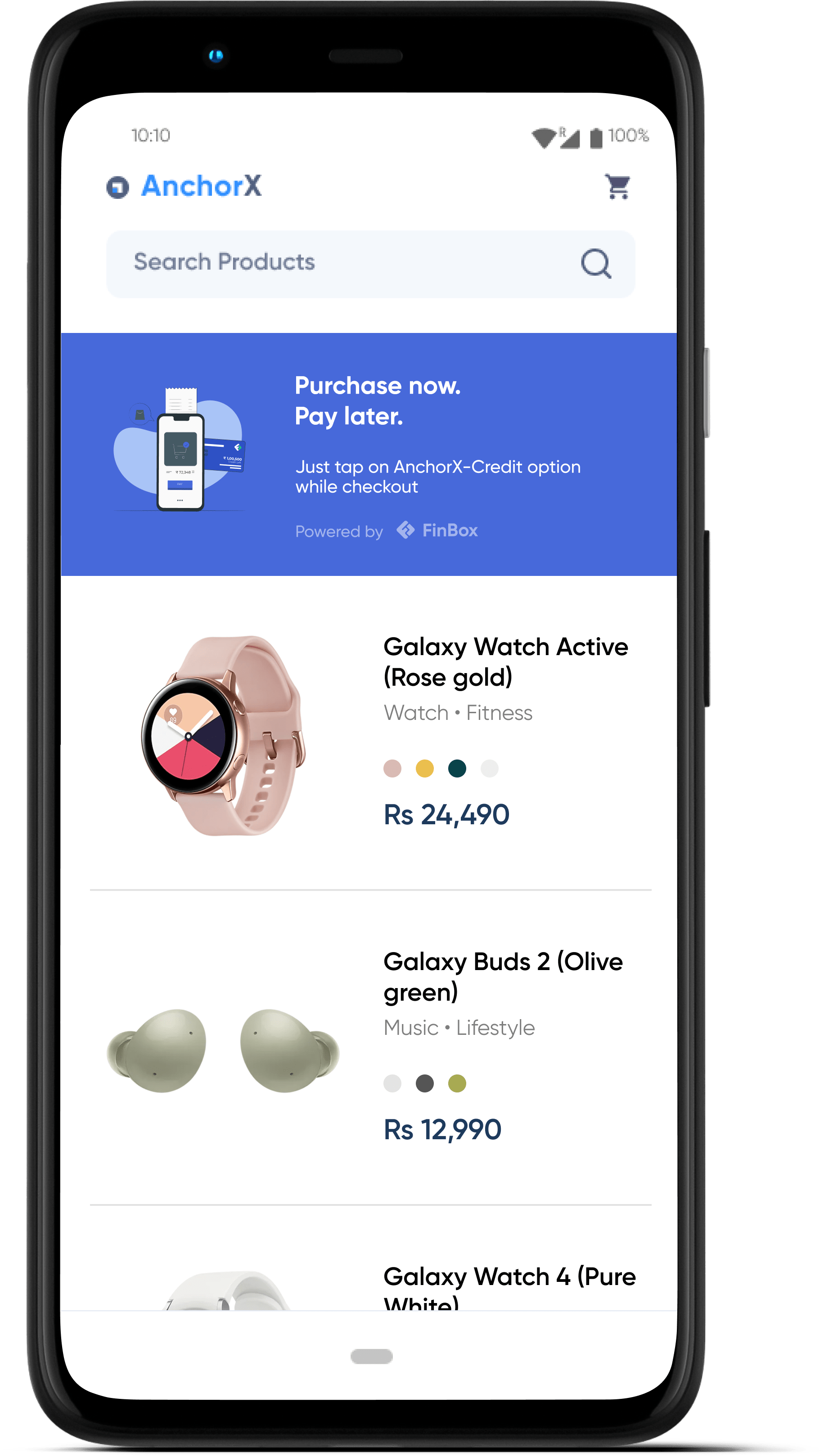

User is shown an offer to apply for a credit line - The first step in the user journey is applying for a credit limit which powers the Buy-Now, Pay-Later. The user will first see the option to activate his credit line via a banner in the anchor app.

User shares his data and his eligibility is checked - The user shares his Credit History, Device Data, Bank Statements, GST (if applicable)

E-KYC - Following this the user completes his eKYC by submitting his

- PAN Card

- Address proof (Aadhaar or Passport)

- Selfie

- Business registration proof.

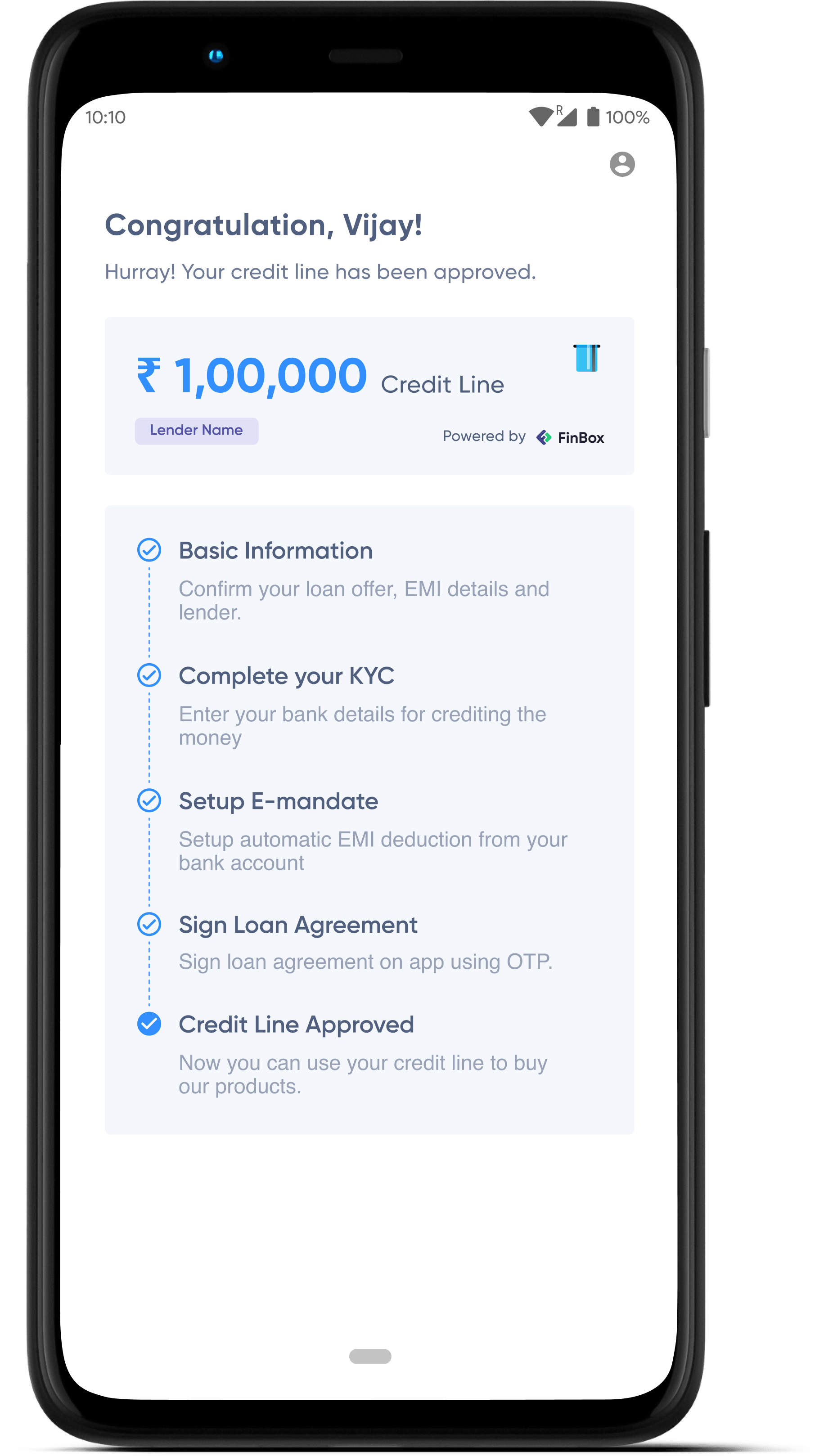

Completes the application process - User e-signs a loan agreement and the application journey is completed.

/Users/sachin/Desktop/redis-developer.github.io/static/img/

Banner shown in anchor app

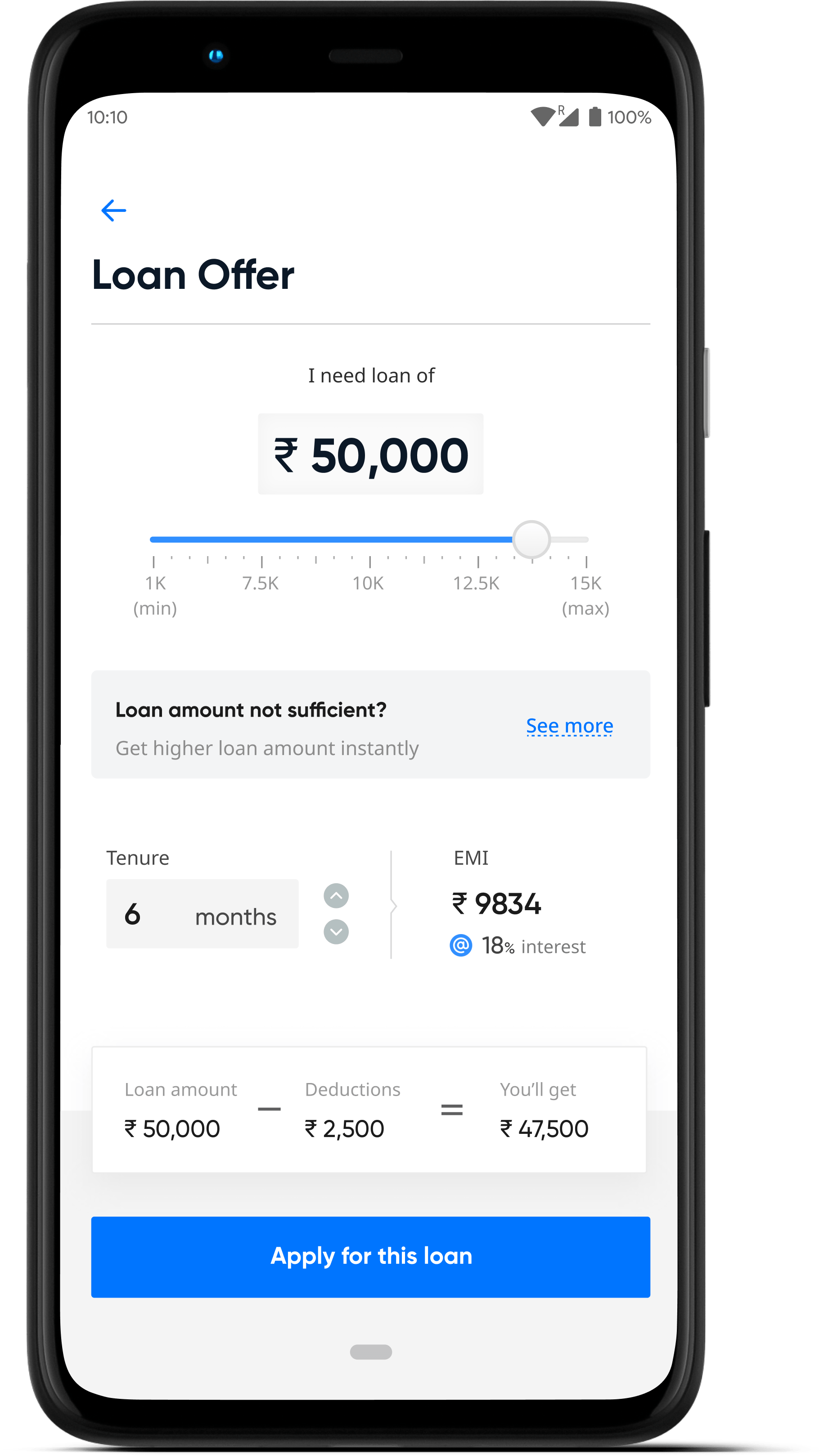

User is shown eligibility

Credit Line Activated

Part 2 - Making Transactions#

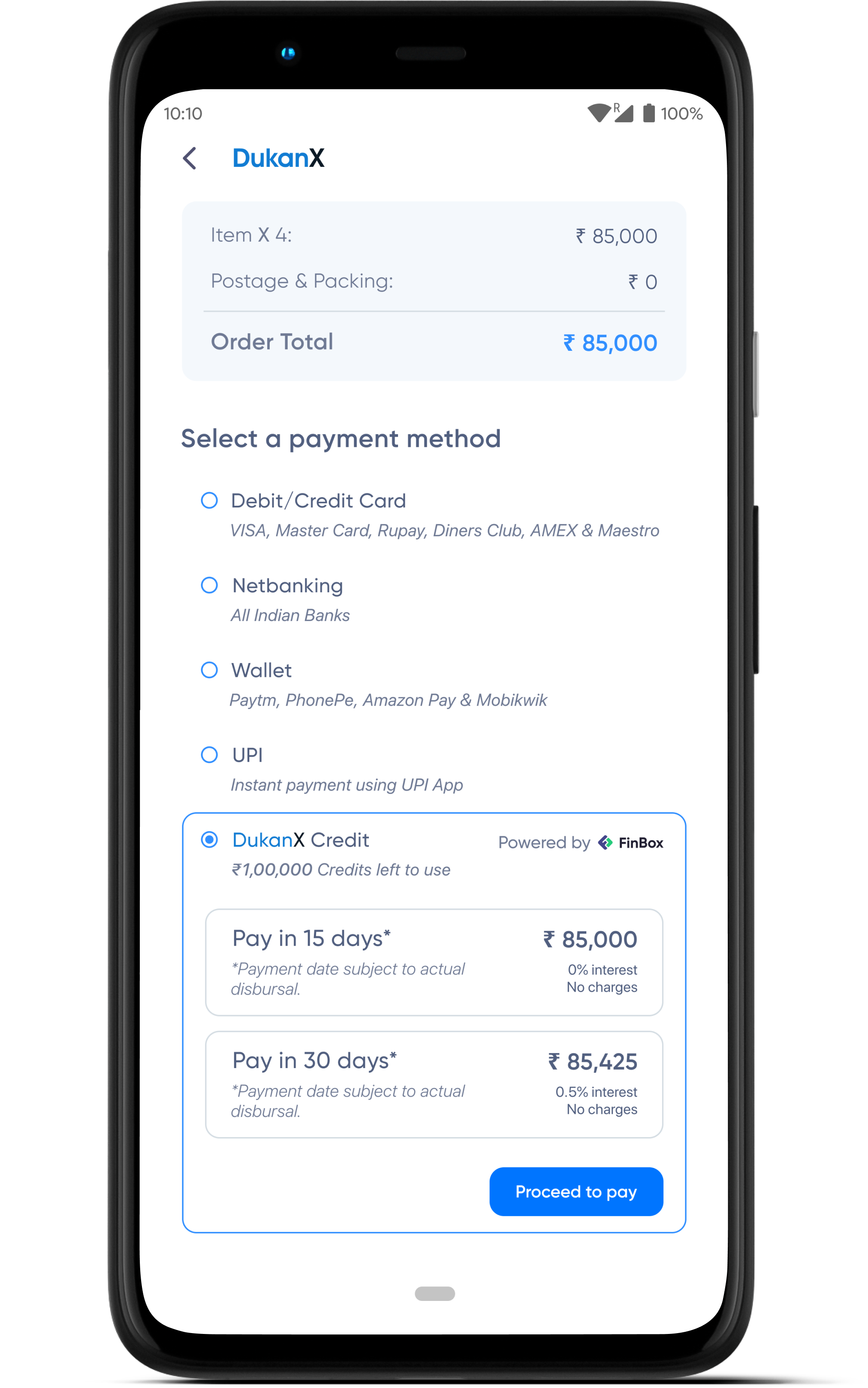

- See Credit Line option at checkout - Users will see Credit Line as a payment option in the Anchor app's checkout page.

- Select repayment plan -They can select their preferred repayment plan and make instant transactions on credit

User is shown a Credit Line option at the checkout screen

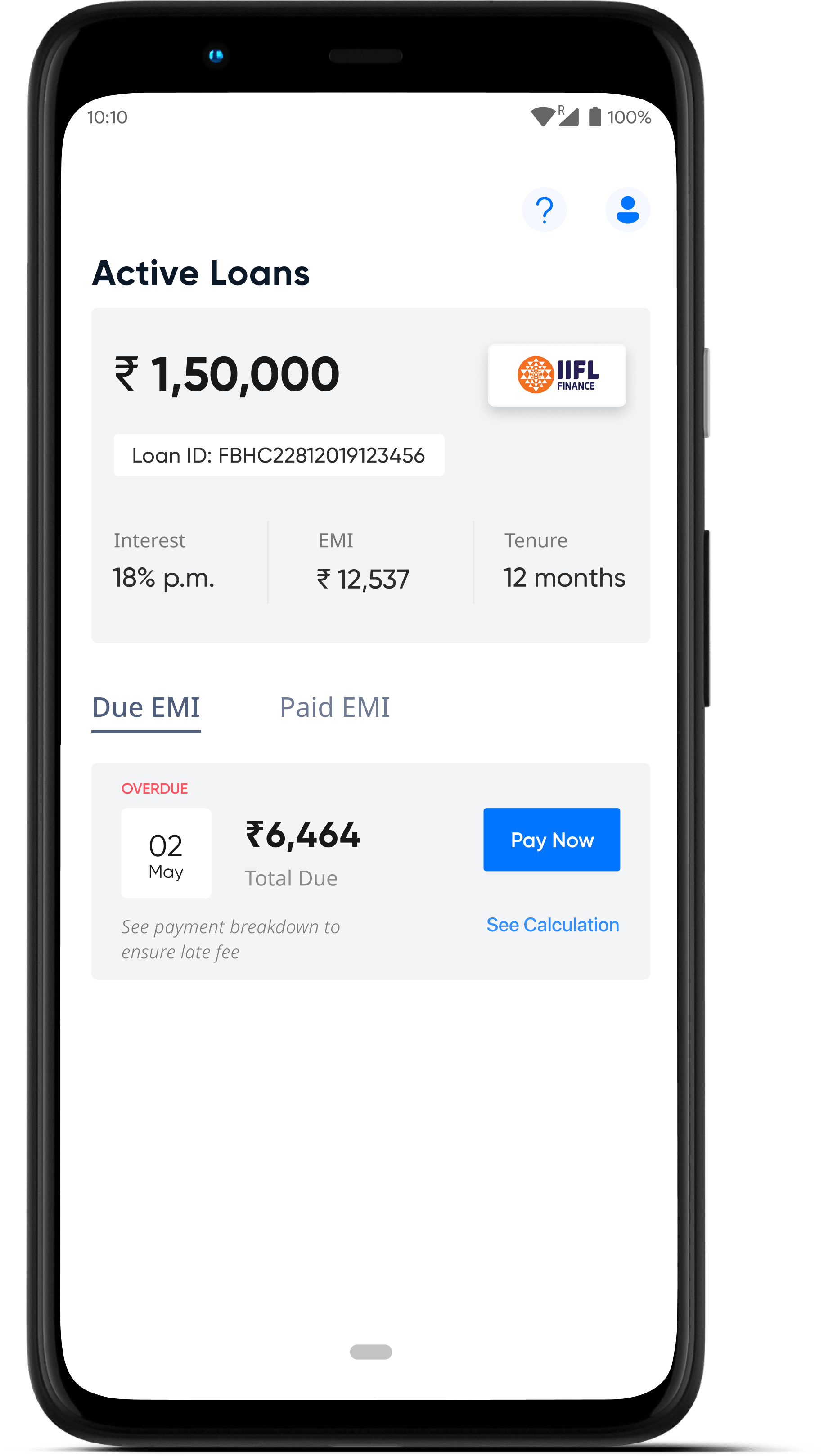

Part 3 - Repayment#

- EMI amount is auto-debited using eNACH or Mandate

- Users can repay from within the app if they want to pay before the due date.

Loan Status