Banners

Once the lending SDK is integrated, we need to show a banner in the app that explains the loan step to the customer. The SDK is to be opened after clicking on the banner.

User Banner API#

This API require Server API Key to be passed in x-api-key header

Endpoint

GET base_url/v1/user/banner?customerID=someCustomerID

Response#

Banner values#

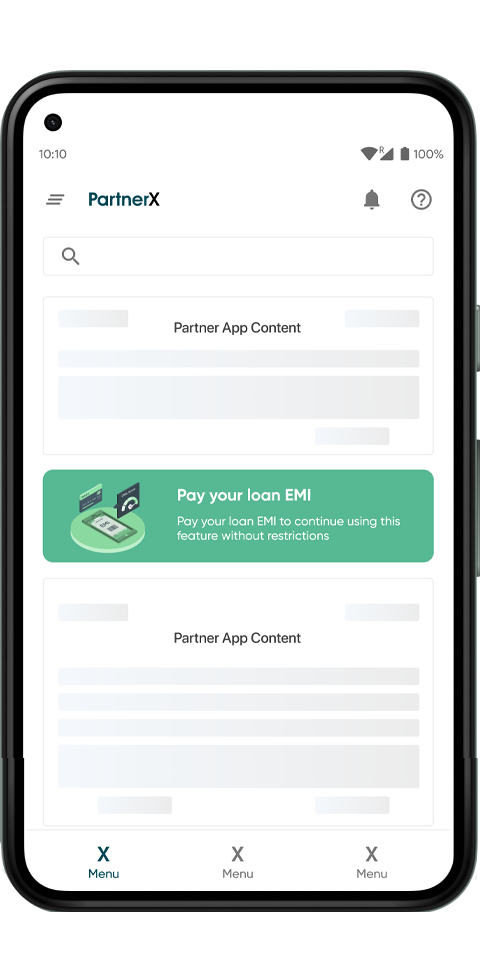

The table below indicates the possible values of banner key, and sample banner designs:

banner key | Description | Sample Banner Design |

|---|---|---|

APPLY | This step symbolises the start of the application and should be shown to eligible users. In case the user with the customer_id is not created in our systems, this is the default value returned by the Banner API |  Download SVG |

INCOMPLETE | This step implies that the application was started, but was left in the middle. In this case, prompt the user to complete the application |  Download SVG |

APPROVED | After application is approved from lender, show user a state informing them that the application has been approved and they can proceed to the next step (like signing the agreement) |  Download SVG |

REJECTED | In case the application is rejected you can notify the user that his loan/credit line application has been rejected |  Download SVG |

ACTIVE | When the loan is disbursed or credit line is activated, you can inform the user through this banner |  Download SVG |

DUE | When EMI is due you can notify the user with the following banner |  Download SVG |

OVERDUE | When EMI is overdue then we need to show the User an overdue state so that he can avoid late fee charge |  Download SVG |

CLOSED | This implies that the loan / credit line is closed | - |

CANCELLED | This implies that the loan / credit line application is cancelled | - |

HIDE | This implies the banner is not be shown to the user at the moment. This is a temporary state and doesn't indicate the eligibility of the user. | - |

INACTIVE | This is specific to Credit Line Journey. It indicates the credit line has been made inactive by the lender. Among OVERDUE and INACTIVE, INACTIVE will take precendence | - |