FinBox Embedded Lending SDK

What is FinBox Embedded Lending SDK?#

FinBox has encapsulated a full-stack credit programme into its FinBox Embedded Lending SDK. It is a drop-in module which adds lending journeys to any digital platform with just a few lines of code. It enables any company to embed fully digital credit programmes in their platforms.

It provides:

- Customizable user journeys for the entire loan lifecycle

- Application

- Loan management

- Repayment

- Advanced underwriting engine

- Third Party Integrations

- Credit bureaus

- eKYC

- E-Mandate

- E-Sign

- Payment Gateway

- Bank Account Validation

- and more

What can you build?#

With the FinBox Embedded Lending SDK, you can build tailored credit programmes for your customers. For example,

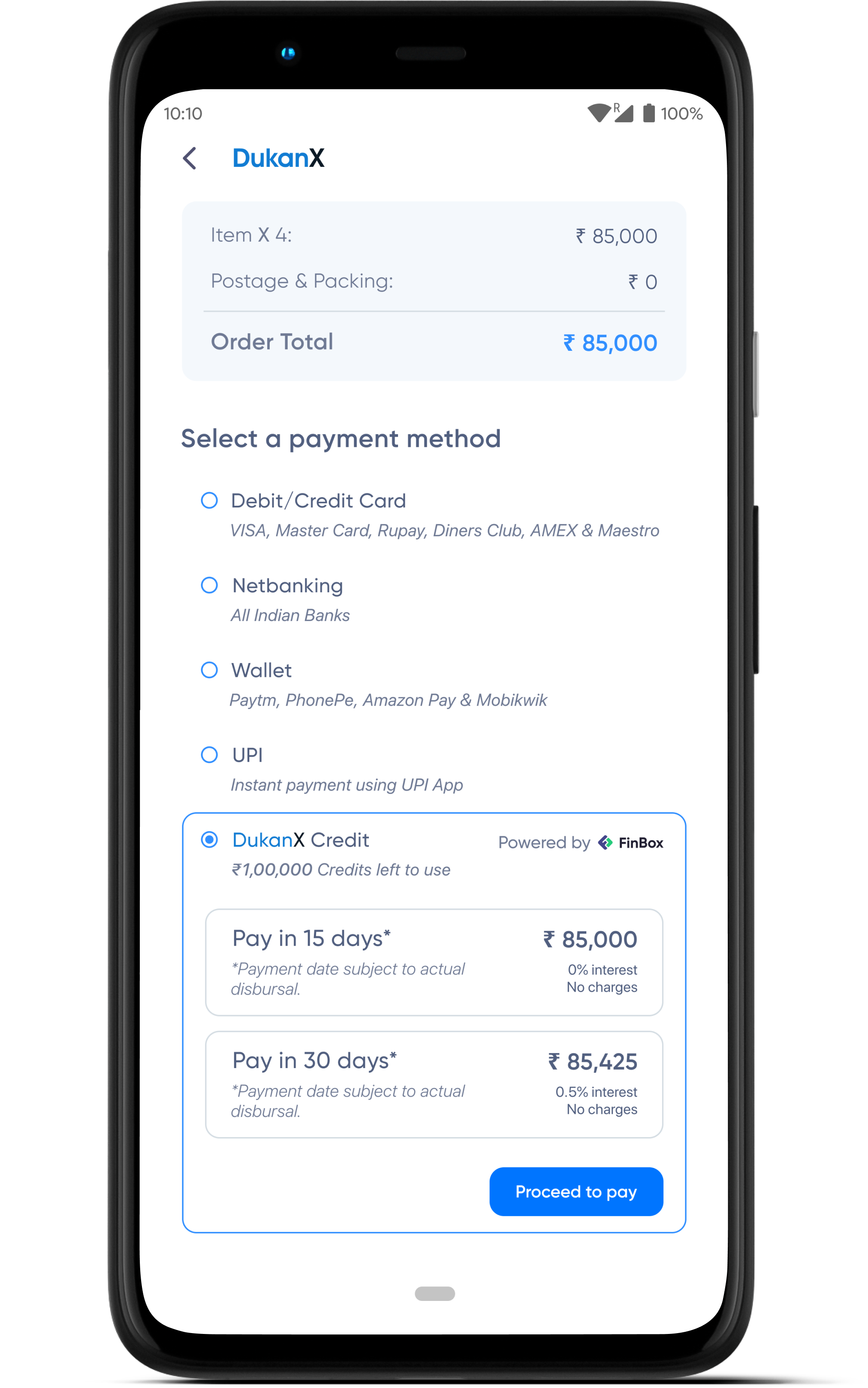

- A Buy-Now Pay-Later checkout option for a B2B E-Commerce App.

- Offer Term Loans to retailers on your accounting app.

- Offer salary advance to employees via an HR-Tech app.

- A credit line powered by an overdraft account on a B2B E-Commerce App.

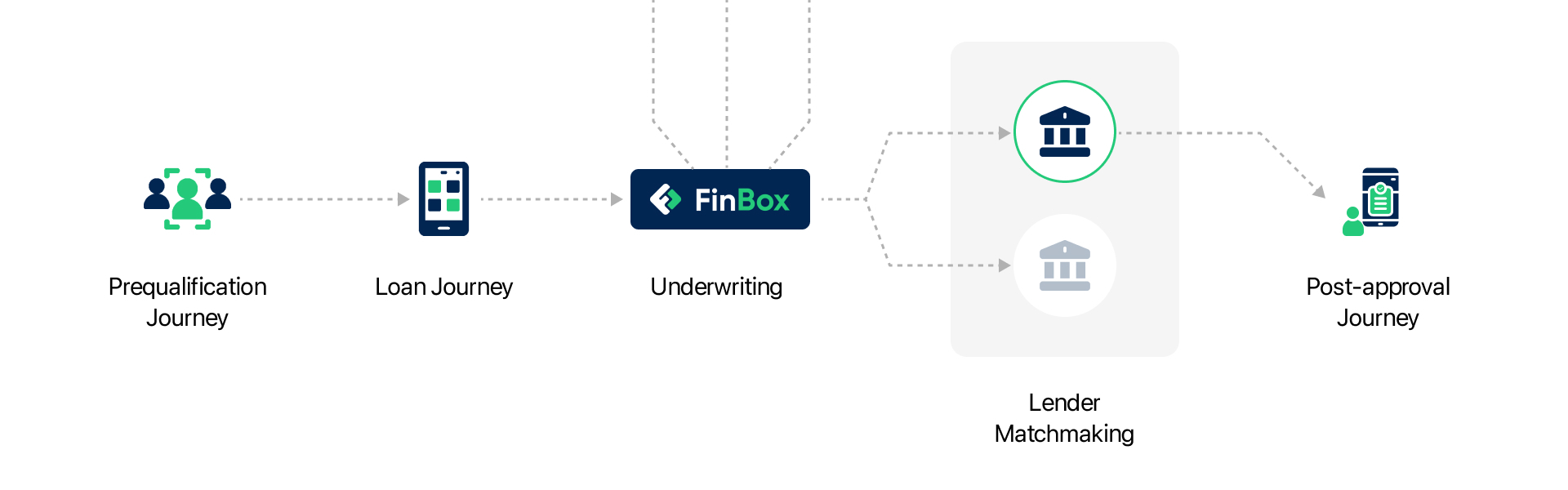

How does the FinBox Embedded Lending SDK work?#

- Digital Platforms place a CTA for availing credit in-context of their existing workflows.

- When user clicks the CTA, FinBox SDK is initialised.

- The SDK encapsulates manages the entire loan lifecycle end to end.

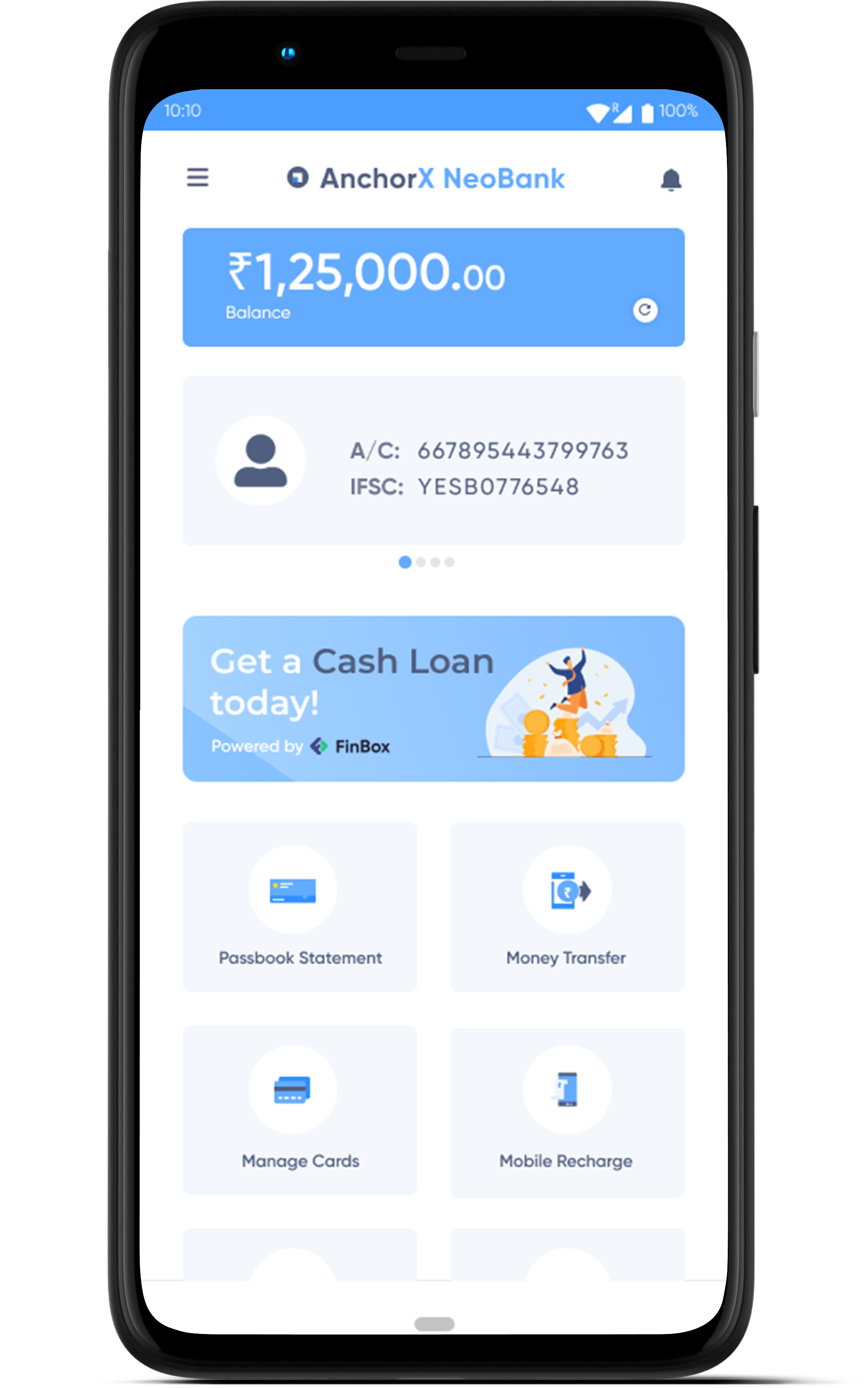

A Neobank offering personal loans

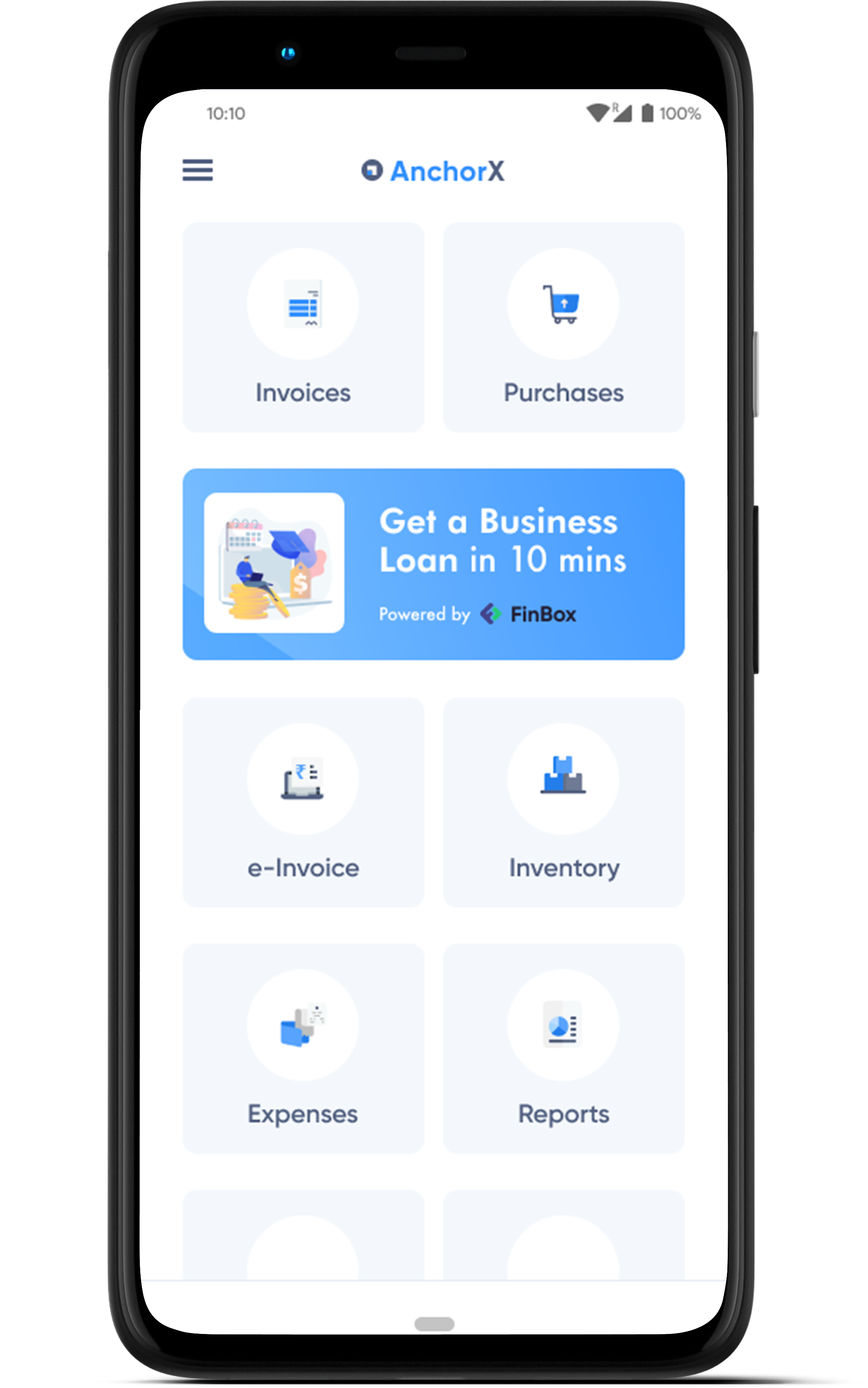

A retail-tech app offering business loans

A B2B E-Commerce app offering Buy Now Pay Later